Introduction

Before we get into the figures that shape your fleet’s path ahead, let’s discuss the firm that turns this switch not only feasible but also money-making.

In the fast-changing world of business transport, choosing to power your fleet with electricity can seem like working through a tricky money puzzle. You must keep your business running smoothly, hit growing green targets, and above all, watch your costs closely. Standard diesel vans have served as the norm for years, yet their steady expenses—like shifting fuel prices and steep upkeep—now act as heavy burdens that are hard to bear. The issue stands out: how can you figure out the True Return on Investment (ROI) for a fresh electric light commercial vehicle (ELCV) compared to the known costs of diesel? This piece gives you a full plan to work out that ROI, showing how new ELCVs bring a clear business edge.

For more than thirty years, the company creating the vehicles covered here has steadily supported the core of business logistics and building work. They do more than just put parts together; they draw from deep roots in tough manufacturing, focusing on precise stamping and welding for car body pieces to designing strong business vehicles. This full, in-house skill set means each vehicle, including their advanced electric range, starts from basics with business-level toughness. They commit to providing dependable, worthwhile business options, aiding firms like yours in cutting daily hassles and stretching the life of your assets. If you want a production ally with a solid history of quality and design strength in business vehicles, you can find out more about their wide skills and background ShanDong TaiRui. Their main goal stays on giving the basic design needed for tough business-to-business uses.

I. Beyond the Sticker Price: A Total Cost of Ownership (TCO) Deep Dive

Shifting your fleet from internal combustion engine (ICE) vehicles to ELCVs calls for a change in viewpoint. The Total Cost of Ownership (TCO) stands as the key measure you need, urging you to see beyond the starting price—the “sticker price”—and examine the vehicle’s money effects across its full working life.

Initial Acquisition Cost (The Sticker Reality)

No one can deny that the starting buy price for a solid ELCV usually tops that of a matching diesel van. This gap, often called the “EV Premium,” forms a big obstacle for fleet leaders. Still, looking at this expense alone leads you astray. In truth, this premium acts as an upfront spend that right away starts creating cost reductions in other vital spots.

The Game Changer: Government Incentives and Subsidies

Wise buying plans make use of nearby, country-wide, and even global perks meant to speed up fleet power shifts. These can cover:

Direct Purchase Rebates: Quick cash back or cuts right when you buy.

Tax Credits: Drops in company or business tax bills.

Operational Incentives: Lower road fees, skips on city traffic charges, or better license deals.

These money helps are set up on purpose to close, or fully wipe out, the price difference between ELCVs and diesel ones, which sharply shortens the recovery time and speeds up your ROI.

II. The Tairui Advantage: Unpacking Operational Cost Savings

The real business worth of ELCVs shows up in everyday running savings, where these vehicles clearly stand apart from diesel types.

Fuel vs. Electricity (The Largest Saving)

For any operation with lots of miles in deliveries, fuel ranks as the top changing cost

Diesel Volatility vs. Electric Stability: Diesel costs face world events and wild market swings. Electricity, especially when pulled in wisely during quiet times (like night charging at a base), brings a much steadier and foreseen cost per kilometer.

Efficiency in Motion: ELCVs turn stored power into movement with much better results than ICE vehicles. The main build of the Urban Delivery Electric Truck cuts energy loss to the bone, so you get more trips per bit of power used. This better power use leads straight to a way lower cost per mile than a similar diesel vehicle.

Maintenance & Downtime (Fewer Moving Parts)

The detailed setup of a diesel engine—with its oil swaps, filters, belts, fuel lines, and advanced pollution controls—locks in a steady, high-price upkeep routine.

Simplified Engineering: The electric drive system stays basically easier, with far fewer parts that wear out over time. This removes almost all liquid swaps (oil, gear fluid), filters, and usual engine checks.

Brake Wear Reduction: ELCVs use regenerative braking, where the electric motor slows the vehicle while grabbing back energy at the same time, greatly cutting down on wear for regular brake parts and discs. This lengthens brake life and further lowers upkeep spending.

High Vehicle Uptime: In business work, time equals cash. With fewer tricky parts, you see fewer failures and less shop time. This strong vehicle uptime proves key for fleet heads, straightly affecting service flow and earnings.

Specialized Utility Case: The Refrigerated EV

For those in cold storage and fresh goods handling, the Refrigerated Cargo Electric Vehicle becomes essential. Here, the electric benefit grows even stronger.

Dual Power Efficiency: Old diesel cold vans usually need the engine to run idle (or a extra diesel setup) to run the Transport Refrigeration Unit (TRU). ShanDong TaiRui’s electric cold vehicles pull power for the TRU right from the main battery system. This skips the need for an extra source or engine running empty, building a double saving layer: cheaper driving costs and cheaper cooling costs.

Consistent Temperature Control: Electric-run cooling setups often hit quicker cool-down speeds and steadier temps, which matters a lot for keeping goods safe and meeting rules.

III. Calculating True Return on Investment (ROI) and Long-Term Value

The real ROI comes to light when you blend these running savings into a full-life money model.

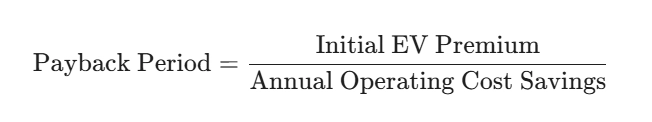

ROI Calculation Framework: The Payback Period

The clearest way to gauge ROI is the Payback Period—the time it takes for built-up running savings (fuel, upkeep, perks) to cover the starting EV premium.

For most busy business fleets moving to an effective vehicle like the A8H Electric Commercial Quadricycle for city-center paths, the payback period can come quick, usually landing in 3 to 5 years based on local power prices and yearly miles. Once past that, the vehicles bring straight cost gains with no catch.

Residual Value and Depreciation

Though future resale values hold some guesswork, a few points point to ELCVs keeping solid long-run worth:

Durability and Longevity: The structurally easier electric drive should last longer mechanically than a detailed diesel engine.

Battery Management: Steps forward in battery heat control and the growing used market for ELCV batteries will steady the value drop.

Body Durability: Supported by thirty years of tough production know-how, the vehicle’s business-grade frame and base stand ready to fight wear and rust, making sure the non-drive parts hold their build strength and looks longer than usual light business vehicles.

Compliance and Market Access (The Hidden ROI)

A key non-money element adding to long-run ROI is entry to markets. As big cities around the world roll out tight Low Emission Zones (LEZ) and even Zero Emission Zones (ZEZ), diesel vehicles run into limits, fines, or full stops. Putting money into an electric fleet guards your work for tomorrow, making sure smooth, open access to all main delivery spots without fine risks or path changes. This steady market entry gives priceless peace for any business looking ahead.

IV. Fleet Services: Maximizing Your Investment’s Success

The move to electric forms a team effort. To hit top ROI, the provider must give strong help services that meet the special needs of EV fleet handling.

Energy Integration and Charging Solutions

You ought to get aid that reaches past the vehicle alone. This covers skilled advice on:

Depot Planning: Checking your current power grid strength and laying out the best charging setup for your site.

Smart Charging: Setting up software that handles charge times on its own to tap low-rate power hours, pushing cost cuts to the max.

Telematics and Predictive Maintenance

Today’s ELCVs act as moving info hubs. Using this info proves vital for handling profits.

Real-Time Monitoring: Drawing on telematics to watch key details like battery health level (SOH), miles left, and driver habits.

Predictive Maintenance: Stepping past fix-it-after fixes. The info lets you guess part breakdowns before they hit, so you can plan upkeep and cut surprise, pricey stoppages.

Tailored Body Customization

Business shipping seldom fits one mold. The chance to adjust the vehicle body to match exact work needs turns right into better flow and ROI. If you need certain shelf setups, custom wall designs, or special door styles, teaming with a maker skilled in body work makes sure the vehicle fits your business role perfectly, not as a half-fit.

V. Conclusion: Driving Future Profitability

The choice to shift your fleet from diesel to electric rests on a plain, expert count of ROI. By going past the first buy price and adding in the big savings from fuel, upkeep, and government aids, the business reason for ELCVs—like the sturdy choices from this skilled business maker—turns strong and clear. The mix of lower daily costs, better vehicle run time, and tomorrow-safe market entry basically flips the money math toward power shifts. By taking this step today, you do more than get vehicles; you put funds into a greener, firmer, and richer tomorrow for your whole shipping setup.

FAQ

Q: How do regional differences in electricity costs affect the ROI calculation for an ELCV fleet?

A: Local power rates form a main changing factor. Fleet leaders should work out the ROI with their own area business rate. For example, fleets in spots with time-based pricing (high day rates, low night rates) can boost savings by using smart charge tools that fill up vehicles in the cheapest times, greatly raising the running cost lead over up-and-down diesel prices.

Q: What is the expected lifespan of the battery packs in these commercial electric vehicles, and how does that impact the vehicle’s residual value?

A: The big-power battery sets in new business ELCVs get built for lasting strength, often keeping 70-80% of first power after 8 to 10 years of work, based on how you use them and the weather. Trusted makers add smart heat control to guard battery fitness. This long life backs a firmer resale worth, since the vehicle stays useful for business longer. Plus, the battery parts can shift to second-use power storage jobs, opening another way to get back asset value.

Q: Are there any hidden costs associated with fleet electrification, particularly regarding charging infrastructure?

A: Yes, the main unseen cost is the starting spend to update your base’s power setup for charging many vehicles at once. This covers power changers, wire fixes, and the charge gear itself. Yet, much like the vehicle buy, governments and power firms often give targeted funds or perks to ease these setup costs, and the long-haul fuel gains soon pay back this spend. A pro power blend check stands as key to budget this front cost right.